your rightsForeclosures

DetailsExplore

your optionsShort salesGovernment

programsShort sale vs

ForeclosureSchedule

Foreclosure

auctionsAdditional

Resources

What is a short sale?

A Short Sale means the net proceeds from the property sale will not cover the total mortgage, liens and closing costs, thus the lien holder (lender) accepts a payoff of less than the amount owed. Since the lien holders will receive less than what they are owed, they must approve the sale. Although lien holders will lose money in a short sale they will often approve short sales because it is less expensive for them than going through the entire foreclosure process.

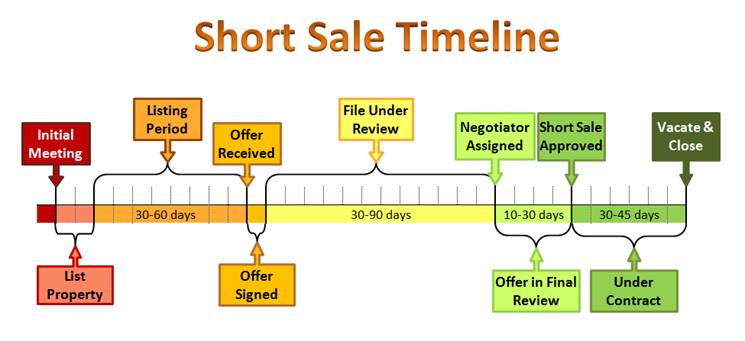

What is the short sale timeline?

——-

IMPORTANT THINGS TO KNOW ABOUT SHORT SALES HOW DOES A SHORT SALE AFFECT MY CREDIT? WHAT ARE THE STEPS FOR SELLING MY HOME AS A SHORT SALE? WHAT DOES THE SHORT SALE PACKAGE INCLUDE? WHAT ARE THE HOMEOWNER’S RESPONSIBILITIES DURING THE SHORT SALE PROCESS? WHAT ARE THE BROKER’S RESPONSIBILITIES DURING THE SHORT SALE PROCESS?——-

Important things to know about short sales:

1. A short sale benefits you by avoiding the foreclosure

A short sale:

– Saves you from the damaging effects of a foreclosure on your credit record – Shows future creditors that you are a person of action in dire situations and will do everything possible rather than walking away – Will often make you eligible to purchase another home sooner – Protects your security clearance (foreclosures can negatively affect ones job security clearance) – Can make you eligible for programs that offer $750-25,000 to homeowners for completing a short sale ($750-3,000 is typical)

2. Selling as a short sale helps the homeowner control the amount of deficiency

The “deficiency” is the difference between the sale price of the home in a short sale or foreclosure and the amount owed on the loan. Our goal is to negotiate with the lien holder(s) to get the short sale approved, liens released from the property AND the sale confirmed as full satisfaction of the loan so that the lien holder CANNOT go after the homeowner for repayment of the deficiency. When a property goes to sale at the Public Auction as a Foreclosure, the homeowner has no control over the bid and deficiency amount.

3. The sale of property as a short sale is not automatically guaranteed, even if we have a valid offer to purchase

The lien holder(s) must approve the short sale in order to release the lien(s) to transfer title to the new owners. Lien holders have various reasons for not approving short sales, some of which do not seem logical, especially when their loss is less in a Short Sale compared to a Foreclosure. However, it is their prerogative to deny the short sale of any given property.

4. In general, the homeowner/borrower does not receive any funds from the sale

Since the lien holders are accepting less than what they are owed when approving a short sale, they do not allow the homeowner to walk away from closing with funds. The homeowner wins by receiving relief from the debt without having a foreclosure on their record.

HOWEVER, the seller can possibly receive $750-25,000 for completing a short sale under specific programs

– FHA loans are typically $750-1,000 – HAFA (Fannie Mae or Freddie Mac) $3,000 – Special programs offered directly by the lien holder can be from $3,000-25,000

5. The homeowner/borrower may be asked to contribute funds to the sale or sign a promissory note

Most of the time, the homeowner does not have to pay to sell their house as a short sale. However, if the homeowner is in a position to make a contribution, the lender could ask them to contribute. For example, if the homeowner has a large amount in their checking account the lien holder may ask for a contribution to minimize the lien holder’s loss. We cannot predict if this will happen for any particular client until we get close to the short sale approval. At that point, the homeowner has the option to continue with the short sale and contribute the requested amount, or cancel the short sale and allow the home to go into foreclosure.

The lender can also ask the homeowner to sign a promissory note for an amount they designate (such as $5-20,000) at a 0% interest rate. The homeowner has the option to decide to sign the note and proceed with the sale or cancel the transaction and go into foreclosure instead. This is the homeowner’s decision at that time.

6. Short Sales do not have a “short” timeline

It takes an average of three to five months for approval of a short sale. Each lien holder has a specific internal system for approving short sales. Approval takes several months because the lien holders must follow their specific process and procedures. Generally speaking, lenders are overwhelmed with files and do not have sufficient trained staff to efficiently manage paperwork in a timely manner, and/or they have to wait for the investor (decision maker who holds the funds) to approve the loss. Depending on the loan, there are also mortgage insurance providers who must approve of the sale as well. Needless to say, short sales take patience, but it can be worth while.

7. If the scheduled Foreclosure Public Auction date is approaching and the Short Sale is not yet approved, the lien holder has the authority to postpone the sale date

Often lien holders will postpone the auction date if in the middle of the short sale process in order to allow more time to review and approval of the short sale. They can postpone it a week or a month at a time, up to 12 months. If they want to postpone it longer, they have to start the foreclosure process over again and re-file the foreclosure with the Public Trustee.

How does a short sale affect my credit? There is no specific category on the credit report for short sales, as there is for foreclosures. In addition to reporting any late payments, a short sale will appear as “paid as agreed,” “settled for less than amount owed,” or “settled.” This can lower the score as little as 50 points if all other debt obligations are paid on time. Due to the unique credit history of each individual and the varying factors of debt to credit limit, it is impossible to give an exact number of points a short sale will affect a person’s credit. However, on average it is between 50-150 points. In contrast, a foreclosure will affect the credit score at least 250 point. It is much easier to bounce back to strong credit scores from a short sale than a foreclosure.What are the steps for selling my home as a Short Sale?

- Gather all documentation for Short Sale Package (see list below)

- Meet with a qualified real estate broker to sign Authorization to Release Information and Listing Documents to list property for sale (The Authorization to Release Information document will allow the Real Estate Broker and Associates to speak with your lender on your behalf to facilitate the short sale process)

- Real estate broker will submit Authorization to Release Information to all lien holders

- Real estate broker will make an appointment with you to come by the house, take pictures, put a key in the lockbox and put a for sale sign in the yard

- Interested buyers will schedule appointments to view the property

- Very interested buyer will submit an offer to purchase property

- Homeowner signs offer

- Submit entire short sale package to each lien holder for approval

- Lien holders perform the preliminary review

- Lien holders order Broker Price Option (BPO) or appraisal (The BPO is like an appraisal to find out the current market value of the property; however it is completed by a Real Estate Broker rather than an Appraiser)

- Lien holders assigns a negotiator to the file

- Lien holders may or may not order a second BPO at this time

- Lien holders will submit file for final review with the investors

- They will possibly counter the offer

- When the short sale is approved, lien holders will send an official short sale approval letter stating their terms of acceptance

- Typically the seller is given 30 days to close the sale with the buyers

- Property needs to be vacated prior to closing

The Short Sale Package includes:

- A hardship letter explaining why the borrower is unable to continue with payments

- Tax statements of the past two years

- Pay stubs of the past two months or if unemployed a letter explaining unemployment

- Bank statements of the past two months for all bank accounts

- A financial worksheet outlining your monthly income, debt obligations and living expenses

- If you do not have any of the items listed above, depending on the situation, a letter of explanation can suffice

Additional Items:

- Authorization to Release Information (allowing the lien holder to speak with us on your behalf)

- Listing Agreement between homeowner and Real Estate Broker

- An offer to purchase the home for the current market value

The lien holders will evaluate your financial situation and the offer price in comparison with their BPO and either approve or decline the short sale. As your real estate broker, we utilize our extensive experience to negotiate with the lien holders on your behalf.

What are the Homeowners responsibilities during the Short Sale Process?

- Turn in all items for short sale package at the first meeting with real estate broker

- Sign Authorization to Release Information form and all listing documents

- Turn in additional requested information promptly: Since the short sale srocess takes several months the lien holders may request updated bank statements and pay stubs. We need this within 24 hours when requested to keep the process moving along smoothly with the lien holders.

- Prepare house for pictures to be taken to market the house for sale

- Provide key to put in lockbox for showings

- Have the house ready for scheduled showings such as; cleaned, tidied up and pets secured

- Accommodate showings

- Sign offer to purchase that will be submitted to Lien Holders for approval

- Let us know if you chose to move out of the property prior to the sale. Especially if it is during the winter months, we need to make sure that the house is “winterized” so the pipes do not freeze and burst causing damage to the house.

- Let us know if you decide to declare bankruptcy (this affects the entire short sale process)

- See additional counsel if you consider moving large sums of money from your retirement account to your revolving checking account. Retirement accounts are protected from collections, however, if you transfer it into a checking account, the lien holder can ask you to use it to contribute to the sale

- Clean and vacate house prior to closing

- Attend closing

- Please be patient-short sales can take three months to over a year to complete

What are the Real Estate Broker and Team’s responsibilities during the Short Sale Process?

- Analyze the market conditions and confirm whether or not the sale is a short sale

- Consult with homeowner to ensure the short sale is the best option for avoiding foreclosure

- Collect all financial documentation from homeowner and ensure all forms are completed correctly

- Strategize list price

- Prepare all documentation to list property for sale as a short sale

- Take pictures to market property

- Set up yard sign and lockbox

- List property on MLS and set up showing service

- Submit Authorization to Release Information to all lien holders

- Market property to all prospective buyers

- Send out email blast to real estate brokers with buyers looking in the area

- Respond to all prospective inquiries from agents and prospective buyers in regards to the property

- Facilitate showing appointments for all interested buyers

- Present offer received to homeowner

- Completed short sale package to submit to lien holders

- Submit executed offer and complete short sale package to lien holders for approval

- Facilitate negotiations with lien holders

- Collect earnest money from buyer’s agent

- Call lien holders frequently to check on short sale approval status

- Remain in contact weekly with homeowner to notify them of the short sale status

- Collect additional documentation from homeowner

- Submit all additional documentation requested by lien holders

- Schedule BPO for valuation of the property

- Facilitate the showing and submission of offers from back-up buyers

- Continue following up with lien holders for short sale status

- Negotiate with lien holders for short sale approval

- When short sale is approved, review short sale approval letter and present terms to homeowner

- Arrange for buyer inspection of property

- Ensure title commitment is provided per contract to purchase

- Ensure Home Owners Association(HOA) covenants and documentation is provided to buyer per contract to purchase

- Watch dates and deadlines to protect homeowner

- Schedule buyer’s appraisal

- Schedule closing with title company

- Ensure buyer’s lender is prepared to close as scheduled

- Attending closing and ensure the proper documentation is signed to completed the short sale transaction

- Arrange for possession of the property by the buyers

- Contact title company to ensure that final payoff was accepted by lien holders

We would be honored to help you discover the current market value if your home and see if a short sale is a feasible option for you or not.

FOR A FREE CONSULTATION CALL 303-912-3320 OR EMAIL TODAY. All consultations are held in the strictest of confidence. Your information will never be shared.IMPORTANT NOTICE

The Federal Trade Commission issued the Mortgage Assistance Relief Services Rule 16 CFR 322 (MARS). MARS defines “mortgage assistance relief service” to include: “negotiating, obtaining or arranging a short sale of a dwelling.” You may stop doing business with us at any time. You may accept or reject the offer of mortgage assistance we obtain from your lender (or services). If you reject the offer, you do not have to pay us. If you accept the offer, you will have to pay us the amount agreed in our listing agreement for our services. Your Castle Real Estate and Monica Perez are not associated with the government and our service is not approved by the government or your mortgage lender. Even if you accept this offer and use our service, your lender may not agree to change your loan. If you stop paying your mortgage, you could lose your home and damage your credit rating.