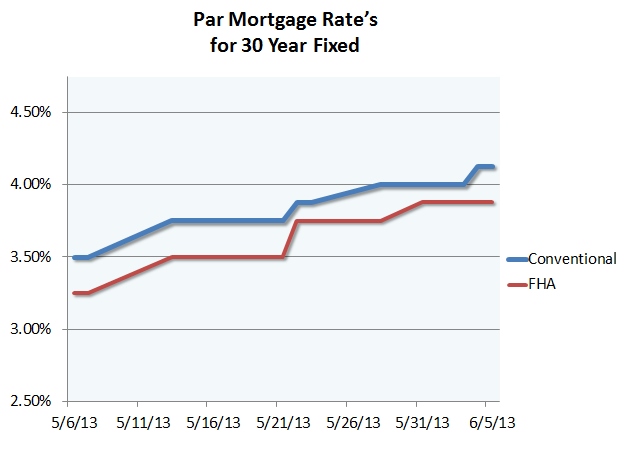

The big news in the last month has been the surge in interest rates for home loans. Across the board, rates for conventional, FHA, VA and all other types of mortgages have increased about .5%, reducing your buying power significantly. The real estate industry is abuzz with speculation about what this is going to mean for the market. There are a lot of industry experts who think that rates are finally off the bottom and will continue to rise from here. One of the most credible sources for industry insight is Lawrence Yung, Chief Economist for the National Association of Realtors said:

“Mortgage rates will continue to rise. They will probably be near 5% by this time next year, compared to the 3.5% average of the past 12 months. The rates will be even higher in 2015 and 2016. Certainly, rising rates are bad news for buyers and some potential homebuyers will be pushed out of the market.”

Keep in mind that even someone as well informed as Yung can’t entirely predict the future. The truth is no one knows for sure what interest rates are going to do. My opinion is that rates are past the bottom and have only one way to go – up. To come to this conclusion I look at the overall improving economy, the Fed’s hinting that they need to slow down the $85 billion monthly bond buying spree and the inevitable return to average interest rates. I think that we’ve seen the last of 3.5% 30-year fixed-interest rates. If have one, congratulations, you can brag about it for the next 30 years!

Buyers

What does this mean to you? Don’t panic. Make a plan.

While it is true that as a buyer you do not have as much buying power now, if the rates continue to raise you may lose more in the near future. My advice to a buyer is if you’re serious about buying a home, it might be time to get one locked up with a sub 4% interest rate to hedge against future rate rises. Certainly you don’t want to rush and foolishly buy a home that does not fit your needs, but if you’ve been kicking around the idea of looking for a home, now may be the time to jump off the fence and get into the game before it’s too late.

So, just how much have rising rates affected your purchasing power? The chart below gives you a good idea. Let’s say you’re a well-qualified buyer and were looking for a house back in April. At that time, if you took out a $200,000 loan your Principle & Interest (PI) payment would have been about $898/month. At today’s rate of about 4%, your payment would jump to $955/month, a 6% increase in payment every month for the duration of your loan!

| Loan amount |

3.5% |

4% |

4.5% |

5% |

| $150,000 | $674 | $716 | $760 | $805 |

| $175,000 | $786 | $835 | $887 | $939 |

| $200,000 | $898 | $955 | $1,013 | $1,073 |

| $250,000 | $1,123 | $1,194 | $1,267 | $1,342 |

| $300,000 | $1,347 | $1,432 | $1,520 | $1,610 |

| $400,000 | $1,796 | $1,910 | $2,027 | $2,147 |

| $500,000 | $2,245 | $2,387 | $2,533 | $2,684 |

Another way to look at it is by calculating the loss of buying power brought about by the increase in interest rates. If your lender in April told you that you were qualified for a PI of $898/month, you could have purchased a $210,000 property by putting 5% down. Today, with a 4% interest rate, you could only afford a $198,000 home. That means that a .5% increase in the interest rate reduced your buying power by a whopping $12,000! This is why rising interest rates must be factored into your future buying decisions. Feel free to call me anytime. We can work together to create a home buying plan that will work for you. Let’s get you into your new home while there is still time.

Sellers

Will the strong sellers’ market soften because of rising interest rates? That’s certainly the million dollar question. Personally, I don’t think rising rates will soften the market in metro Denver for the foreseeable future. It is still SUCH a strong sellers’ market and the inventory is still SO low that we still have an enormous imbalance in the market, with way more buyers than sellers. Maybe someday down the road rates will skyrocket so high that they really put a damper on the sellers’ market, but I don’t see that happening any time soon. I’m convinced the seller’s market will continue for at least the next 6-12 months and perhaps much longer.